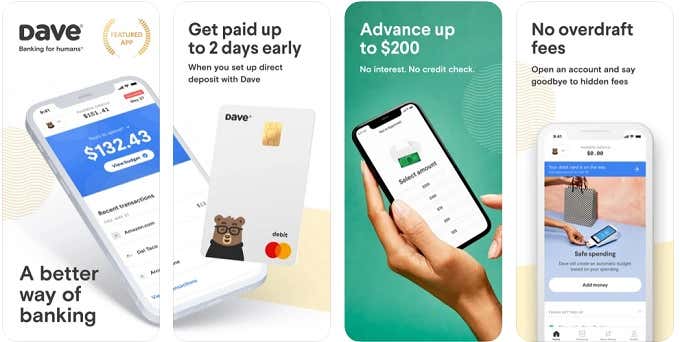

Dave (iOS and Android)

Billing itself as “banking for humans,” Dave wants you to think of it as your financial friend. All users of the app get a $100 cash advance facility, and if you set up a direct deposit with Dave, that facility goes up to $200. The app lets you get your paycheck up to two days earlier than it would usually arrive. Although it costs $1 a month in fees to use the app, you’ll save much more than that in accidental overdraft fees. Dave keeps track of whether you use an overdraft and lets you make use of its facilities to prevent unnecessary overdraft fees. Dave seems like a great deal, but we are a little concerned that the app makes money partly from users’ goodwill through tips, which is perhaps not the most sustainable model.

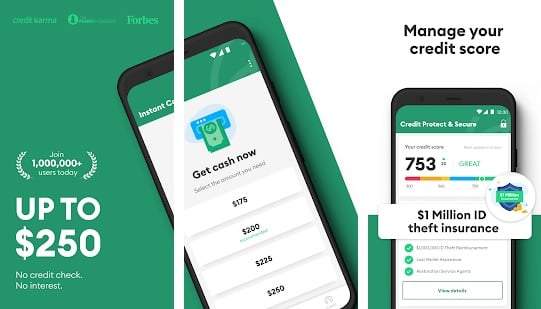

Brigit (iOS and Android)

Brigit is another smart cash advance app that uses algorithms to predict when you’re going to run out of money. Then it automatically puts up to $250 in your account. Of course, that’s assuming you’re paying the $9.99 membership fee. Free users just get the warning, but not the safety net.

No limit to cash advance requests, as long as you cleared the last one.Intelligent budget management to help you make your bills.Cash advances are fee- and interest-free.The monthly app fee is only $1

Cons:

Dave makes money from user tips; it’s unclear how sustainable this is.

Compared to apps like Dave, the fee does seem rather steep. However, considering how expensive accidental overdraft fees can be, it’s still not much money in the greater scheme of things. Brigit is also more lenient on repayments than most. It’s possible to delay repayment of your advance, depending on your profile. The budget helper and side-job features can also help you manage your money better and make more of it if you need to. In general, this is a well-designed service with no severe downsides.

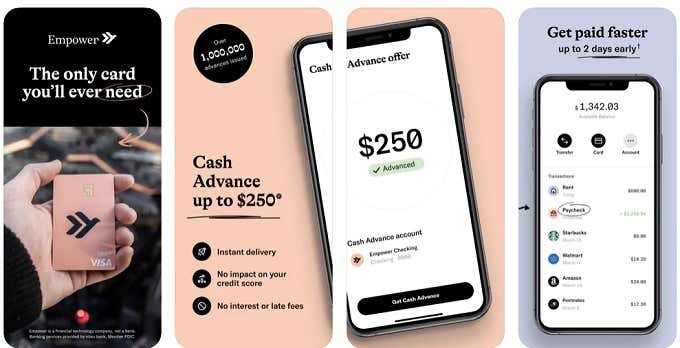

Empower (Android and iOS)

Empower is a typical cash advance app that offers more or less the same amount of money and a similar set of features to something like Brigit. It doesn’t set itself apart from the apps it’s competing against, but we shouldn’t hold that up as a negative point.

Solid $250 cash advance offer.Open to those with bad or no credit score.Automatic overdraft protection.Includes $1 million in identity theft protection for subscribers.Repayment extensions are possible.

Cons:

$9.99 monthly fee to access cash advance and insurance.

Empower claims to have the best budgeting tools compared to other cash advance apps, but that’s hard to prove objectively. We’ve also seen several complaints from users related to login issues or app bugs. So perhaps Empower’s software needs to spend a little more time in the oven. Still, it’s worth adding to the list of options if you don’t get approved by one of the other providers, and it seems these minor issues affect only a minority of users.

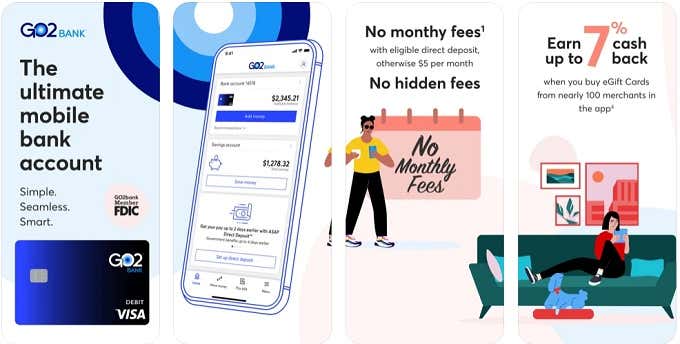

Go2Bank (Android and iOS)

Go2Bank is a lot more than just a cash advance application. The only actual “cash advance” you get is the $200 overdraft protection, but that effectively comes down to the same thing.

$250 advance limit.Get paid up to 2 days faster.Intelligent Autosave moves extra money into a separate account.

Cons:

$8 monthly fee to access all features after a 14-day trial.Some technical app complaints from user reviews.

Instead, Go2Bank aims to offer a comprehensive banking service, which is why you’re encouraged to set up direct deposit with the app and switch your finances over for all sorts of transactions. It’s a good banking solution for users who can’t find a place with mainstream formal banking.

Earnin (Android and iOS)

EarnIn offers an interesting twist on how most cash advance applications work. It uses GPS tracking and information about where and for how long you work to figure out a fair advance amount.

$200 overdraft protection.No fees for direct deposit users.Free withdrawals at approved ATMs using your Go2Bank card.High (1%) APR on savings.Get your paycheck up to 2 days early.

Cons:

$5 fee without direct deposit.3% fee if you withdraw from out-of-network ATMs.

This is what allows EarnIn to offer a maximum advance of $500. However, we suspect that only a minority of users will get that much. The app also offers prizes to get more people to save, with every $10 you save giving you an entry towards winning cash. The total prize pool, according to EarnIn, is 10 million dollars.

Borrow up to $500 at up to $100 per day.Intelligent tracking for responsible lending.Savings incentivized via prize draws.

Cons:

Like Dave, tips are a part of how Earnin stays afloat.

Help When You Need It Most

Everyone can get into a situation where just having some cash for a few days can prevent hardship. Getting a cash advance before we had these cash advance apps was a nerve-wracking process, usually involving lining up with a group of other hopefuls and filling in a heap of paperwork just to get a few hundred dollars. With apps like these, the whole process becomes clean, fast, and easy. If you need more help managing your finances, why not read The Best Budgeting and Expense Tracking Apps?